The Union Budget 2025-26, presented by Finance Minister Nirmala Sitharaman, introduces key reforms in taxation, payroll compliance, and MSME support. As India’s trusted payroll and HR tech provider, we at Kredily are dedicated to helping businesses seamlessly integrate these changes into their operations.

This article breaks down the critical announcements impacting payroll processing, employee taxation, compliance, and business operations for MSMEs and startups. We also explore how HR professionals, finance teams, and business owners can leverage these updates to enhance workforce management and operational efficiency.

Union Budget 2025: Key Highlights for Payroll and HR Compliance

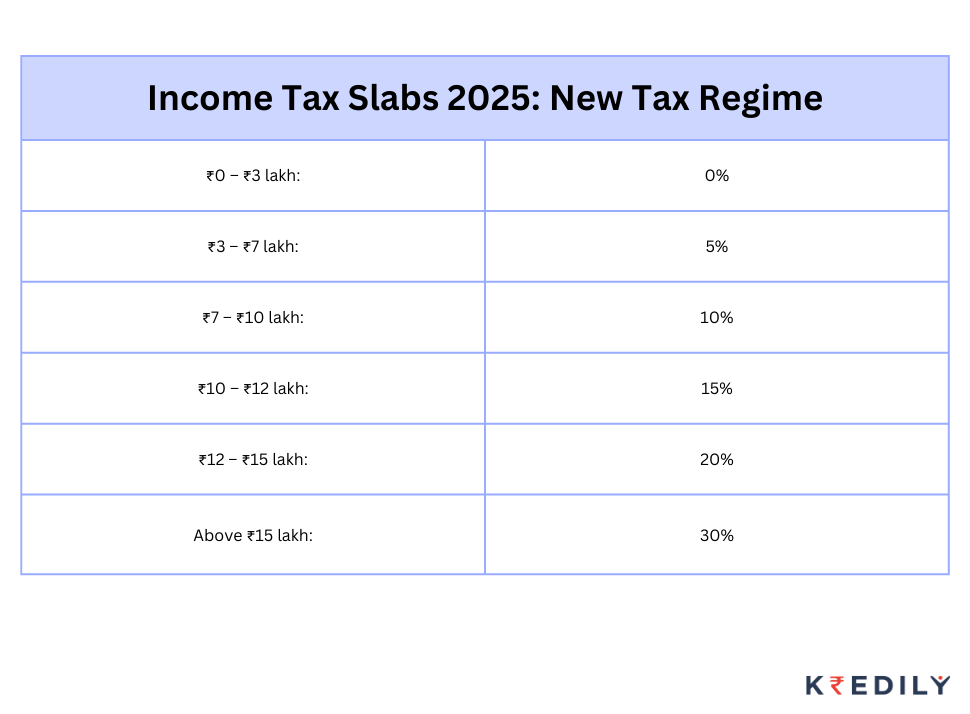

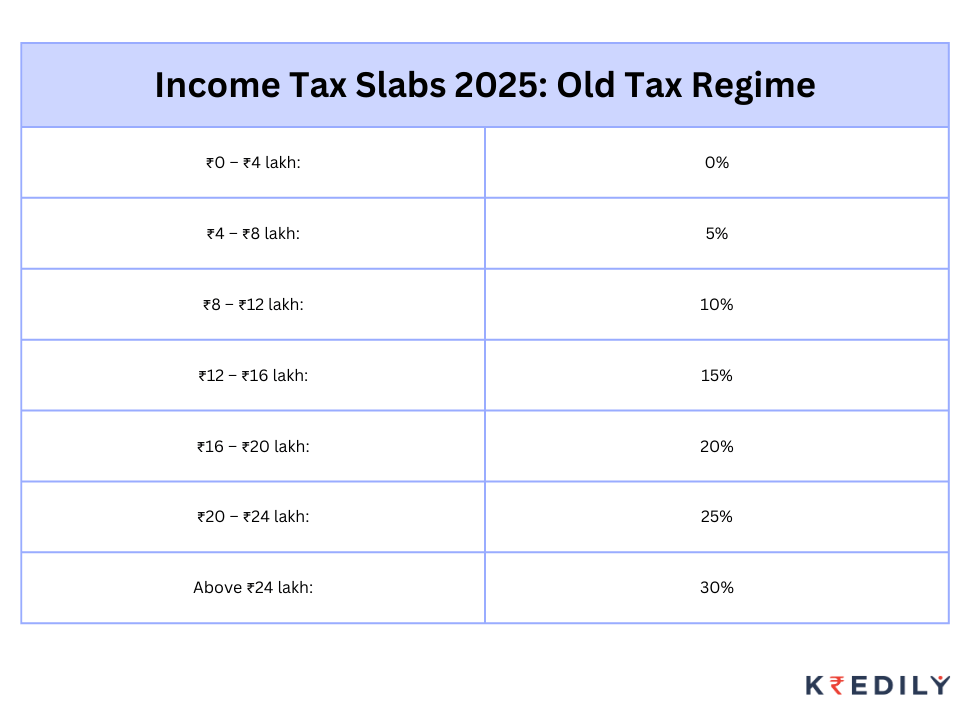

1. Increased Take-Home Pay: Revised Income Tax Slabs

The government has revised tax slabs under the New Tax Regime, resulting in greater take-home pay for employees. The Old Tax Regime remains unchanged for those opting for it.

Key Differences & Considerations:

- The new tax regime provides lower tax rates but removes most deductions and exemptions.

- Employees should evaluate their financial plans to decide between the old and new tax regimes.

- Payroll teams need to adjust tax calculations, and Kredily handles this automatically for compliance.

2. TDS & TCS Updates: Reduced Compliance Burden

The budget introduces higher TDS thresholds for several income sources, reducing tax deductions and compliance work.

Key TDS Threshold Changes:

- Interest for senior citizens: Increased from ₹50,000 to ₹1,00,000.

- Rent: Increased from ₹2.4 lakh to ₹6 lakh per year.

- Dividend income: TDS threshold raised to ₹10,000.

- TCS on education loans removed: Simplifies payroll tax deductions for employees funding their children’s overseas education.

What This Means for Payroll Teams:

- Payroll software must be updated to reflect new TDS thresholds, ensuring accurate deductions.

- Lower tax deductions on smaller incomes mean reduced compliance workload for HR and finance teams.

- Kredily ensures real-time updates to payroll software for accuracy.

3. Gig Workers & Social Security Enhancements

- Gig workers will now be covered under PM Jan Arogya Yojana, providing them with health insurance benefits.

- Formal identity cards for platform workers will enhance their access to financial services like loans and credit.

HR & Payroll Action Points:

- Companies hiring gig workers should revise HR policies to align with the new social security norms.

- Payroll teams need to streamline benefits enrollment and statutory deductions for gig and contract workers.

Key Announcements for MSMEs & Startups in the Union Budget 2025

4. MSME Growth Boost: New Classification & Credit Support

Revised MSME Classification (2025):

- Micro enterprises: Investment limit ₹2.5 crore, turnover ₹10 crore.

- Small enterprises: Investment limit ₹25 crore, turnover ₹100 crore.

- Medium enterprises: Investment limit ₹125 crore, turnover ₹500 crore.

More Credit Access:

- The credit guarantee limit increased from ₹5 crore to ₹10 crore, unlocking ₹1.5 lakh crore in funding.

- MSME credit cards were introduced with a ₹5 lakh limit for better cash flow management.

What This Means for MSME Customers Using Kredily:

- Easier access to funding can help MSMEs invest in payroll & HR software.

- Business expansion opportunities while retaining MSME tax benefits.

- Increased demand for HR automation as businesses scale up.

5. Startups: Funding & Tax Benefits Extended

- Startup Fund of Funds expanded with ₹10,000 crore in fresh capital.

- The startup credit guarantee limit was raised from ₹10 crore to ₹20 crore.

- Tax exemptions for startups are extended until March 31, 2030.

Implications for Startups:

- Improved funding access will enable startups to invest in HR technology.

- Growth in job creation will increase the need for payroll & HR solutions.

6. Ease of Doing Business & Compliance Simplifications

- New Income Tax Bill: Aims to simplify corporate tax filing and compliance.

- Jan Vishwas Bill 2.0: Expected to decriminalize over 100 business-related minor offences.

- Simplified KYC Compliance: Revamped Central KYC Registry for smoother compliance.

- Digital-First Tax Administration: Enhanced automation will reduce HR and finance workload.

How Kredily Supports Businesses:

- Automated payroll tax updates are integrated into our platform.

- Compliance monitoring aligned with evolving MSME norms.

- Simplified TDS calculations per the revised tax structure.

Experience effortless payroll compliance and reduce your workload—Get a Free Live Demo Now!

7. Business & Infrastructure Growth Initiatives

- Public-Private Partnerships: ₹1.5 lakh crore allocated for state-led MSME infrastructure projects.

- UDAN Expansion: 120 new regional flight routes to improve business connectivity.

- PM Gati Shakti Data Access: Businesses can use logistics data to enhance efficiency.