Your Payroll, Our Priority Accuracy and Satisfaction.

Automate complex payroll workflows in minutes.

Existing User? Sign In

Automate complex payroll workflows in minutes.

Existing User? Sign In

From startups and SMEs to enterprises, our payroll solution is designed to cater to businesses of all sizes. It offers a range of intuitive and feature-packed tools to meet your specific requirements.

Ensure fair compensation for additional work hours with Kredily's automated system, accurately calculating overtime wages.

Optimize workforce coordination and productivity by efficiently managing employee schedules and rotational shifts.

Streamline your payroll management by effortlessly downloading and distributing payslips in bulk, saving you time and effort.

Facilitate Full and Final (FnF) settlements with Kredily, ensuring a seamless employee exit process and a smooth transition.

Simplify employee offboarding processes, including documentation, clearances, and exit formalities, to ensure a seamless departure.

Automatically calculate income tax deductions accurately, ensuring compliance with tax regulations and minimizing manual errors.

Facilitate flexible compensation by offering employees variable payouts during the mid-month for enhanced financial convenience.

Customize salary structures to align with your organization's unique requirements, encompassing a range of allowances, deductions, and benefits.

Simplify Form 12BB & Form 16 generation and submission, facilitating accurate reporting of employee investment and tax-saving declarations.

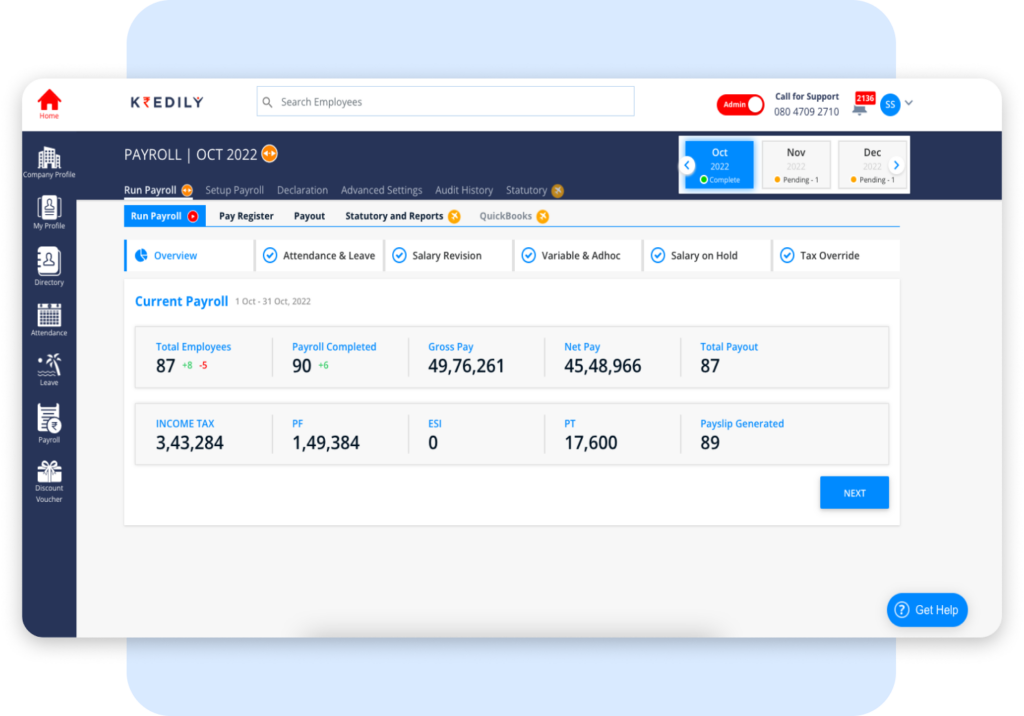

Kredily payroll software is specifically crafted for small and medium-sized enterprises in India, providing a comprehensive suite of features including employee management, salary processing, tax calculations, statutory compliance, payslip generation, bank transfers, and more. As a cloud-based solution, it ensures accessibility from any location with an internet connection, along with secure data storage and automatic updates. Kredily further enhances user convenience with a dedicated mobile app for employees to access their payslips and leave records. With its user-friendly interface and budget-friendly pricing plans designed for small businesses, Kredily stands as the optimal choice for payroll management in the Indian SME landscape.

In summary, Kredily payroll software emerges as an excellent option catering to the needs of small and medium-sized enterprises in India. It offers an economical, cloud-based payroll solution replete with diverse features and a user-friendly interface, making it a wise choice for businesses in this segment.

As a growing not-for-profit organization, we were in search of an HR solution that could efficiently manage our core HR processes without a substantial financial burden. Kredily came to our rescue by providing a free Core HR suite. Its straightforward and user-friendly interface made implementation a breeze, requiring no extensive training. It's impressive to witness an HRIS company in India offering such valuable services at no cost to its clients.

We are extremely content and delighted to have Kredily as our HRMS partner. Over the course of our partnership, Kredily has gained a profound understanding of our vision and workflow, seamlessly integrating with our operations without any disruptions or complications on our end.

I discovered Kredily at precisely the moment when I began exploring tools and services for HR operations. As a startup founder, I was dedicating a significant amount of time to maintaining attendance, leave, and payroll records. Kredily introduced greater transparency into our company's HR processes. The setup was straightforward and well-guided. I particularly appreciated the thoroughness of the application regarding HR procedures.

We are delighted to be connected with Kredily, which has been immensely helpful in HRMS management. For a small NGO like ours, having a comprehensive solution on a single platform to manage the employee database and authorization matrix has been a significant asset. It has greatly facilitated our efforts to establish our organization as an efficient institution.

Streamingo, a startup in the Artificial Intelligence sector, like many bootstrapped startups, was in search of a cost-effective HRMS solution. To our pleasant surprise, we discovered that Kredily not only provides an user-friendly HRMS solution but also offers it at no cost. Kredily encompasses many features found in standard HRMS solutions, and it's remarkably straightforward and user-friendly. Implementation is swift, and the support provided by Kredily is exceptional.

We opted for Kredily primarily because of the simplicity it brings, particularly in our industry. They have a keen understanding of the challenges that most companies encounter and provide a solution that can adapt to the needs of various organizations. Kredily has simplified the process of selecting the modules we require. We're eagerly looking forward to our continued progress and the possibilities that lie ahead. Their customer-centric team has been incredibly supportive, assisting us whenever we've encountered challenges.

Payroll refers to the total amount of money that a company pays to its employees for their work during a specific period of time, typically on a regular basis, such as weekly, bi-weekly, or monthly. This can also refer to the department within a company responsible for managing employee compensation and benefits, including calculating salaries and wages, deducting taxes and other withholdings, and distributing paychecks or electronic transfers. It is an essential function of any organization and is critical for ensuring that employees are compensated accurately and on time, while also complying with relevant laws and regulations related to taxation, social security, and other labor laws.

Kredily Payroll is different from other payroll software in its ability to offer a seamless, hassle-free payroll experience and that too without any cost.

Payroll services costs vary depending on several factors. However, using payroll services has consistently been proven economical or cost-effective over the long term. However, Kredily’s HR & Payroll software is free, and any organisation can handle payroll functions without paying.

There are different apps and software a company uses for processing payroll. The market is full of such apps though they all have different price ranges for different features. But you can use Kredily HR and Payroll software to process your payroll without paying.

The formulas used for payroll calculations may vary depending on factors like tax laws and company policies. However, common formulas include:

a) Gross Pay = Total hours worked × Hourly rate or Salary per pay period

b) Net Pay = Gross Pay − (Deductions + Taxes)

c) Overtime Pay = Overtime hours × Overtime rate

d) Deductions = Tax withholdings + Employee benefits contributions

To put employees on payroll, follow these general steps:

a) Collect necessary employee information (e.g., W-4 forms, direct deposit details).

b) Determine the employee’s pay rate and salary basis (hourly, salaried).

c) Set up the employee in the payroll system, including tax withholdings and benefit deductions.

d) Track employee attendance, hours worked, and any applicable overtime.

e) Process payroll according to the established pay schedule, ensuring accurate calculations.

f) Distribute paychecks or arrange for direct deposit.

g) Maintain proper payroll records and comply with legal requirements.

Some valuable payroll terms to know include:

a) Gross Pay: The total amount earned by an employee before any deductions.

b) Net Pay: The amount an employee receives after deductions (taxes, benefits, etc.).

c) Withholdings: Deductions from an employee’s gross pay, such as taxes and benefits.

d) Pay Period: The timeframe for which employee wages are calculated and paid (weekly, biweekly, and monthly).

e) Direct Deposit: Electronically transferring employee wages directly to their bank accounts.

f) Form 16: A tax form that summarizes an employee’s earnings and tax withholdings for a given year.

Some common employer-paid benefits include:

a) Holidays: Paid time off for designated public holidays.

b) Vacation: Paid time off granted to employees for personal use or leisure.

c) Sick Days: Paid time off provided to employees who are ill or require medical care.

d) Insurance: Health, dental, vision, or life insurance coverage provided by the employer.

e) Retirement Plans: Employer-sponsored plans (e.g., pension) to help employees save for retirement.

f) Profit Sharing Plan: A program where a portion of a company’s profits is distributed to employees.

Common mistakes that can occur during the payroll process include:

a) Incorrect data entry, leading to inaccurate calculations.

b) Failing to update employee records promptly (e.g., salary changes, tax withholdings).

c) Missing payroll deadlines, resulting in delayed or incorrect payments.

d) Mishandling employee benefits and deductions, leading to errors in net pay.

e) Non-compliance with tax laws and regulations, resulting in penalties.

When selecting a payroll service software, consider factors such as:

a) User-friendly interface and ease of use.

b) Integration capabilities with other HR or accounting systems.

c) Security measures to protect sensitive employee data.

d) Customization options to fit your specific payroll needs.

e) Scalability to accommodate your organization’s growth.

f) Customer support and reliability of the software provider.

Outsourcing payroll may be a suitable option when:

a) Your organization lacks the necessary expertise or resources to handle payroll internally.

b) You want to reduce the administrative burden and focus on core business activities.

c) You need access to specialized payroll knowledge and stay updated with changing regulations.

d) You want to improve accuracy and ensure compliance with payroll laws.

e) You aim to leverage the technology and efficiency offered by professional payroll service providers.