Effortless Tax Management for Payroll Processing

Automate Tax Management and Maximize Tax Efficiency

Existing User? Sign In

Automate Tax Management and Maximize Tax Efficiency

Existing User? Sign In

Browse through tax investment options, declare your investment and submit proof online.

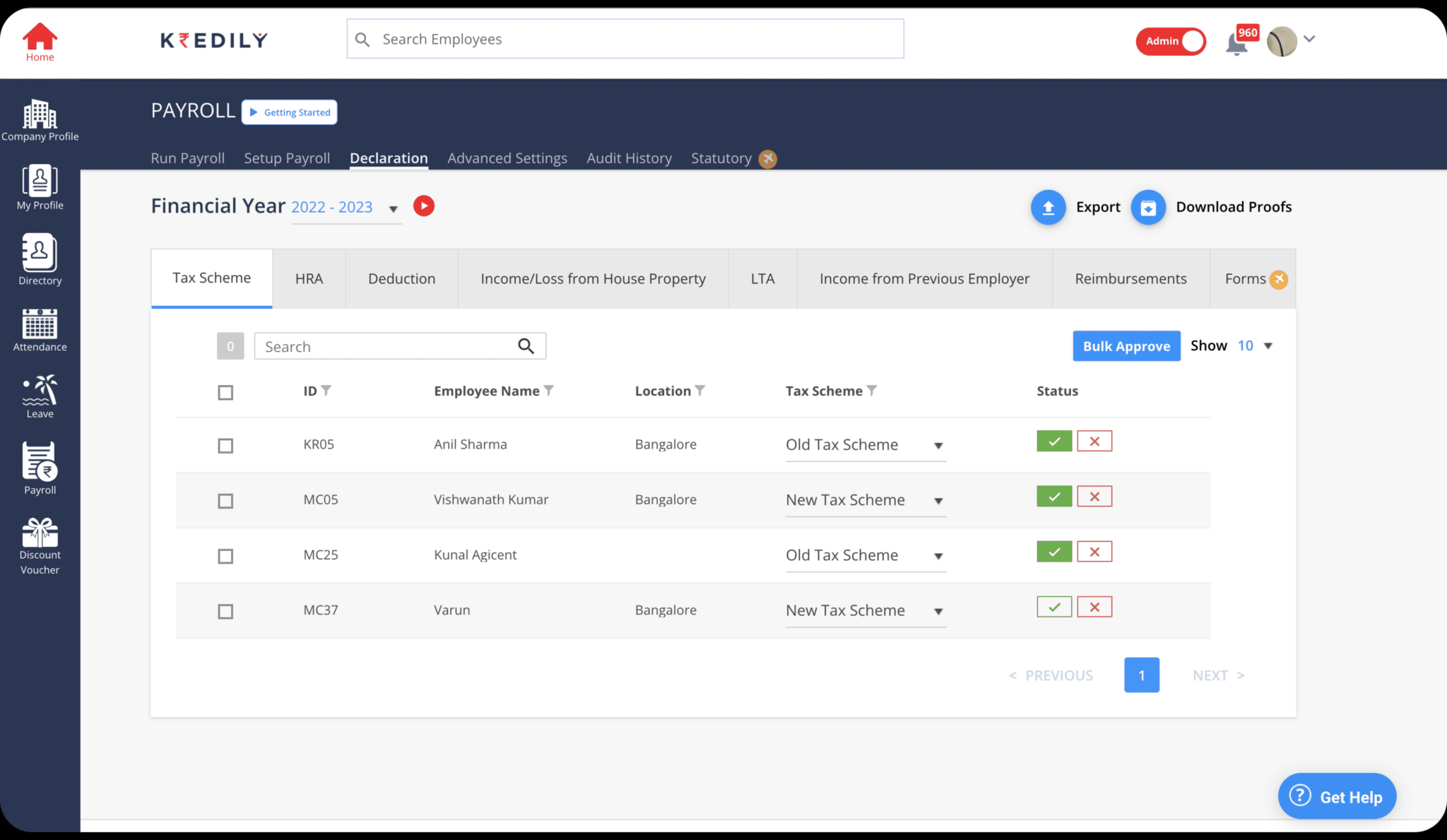

Authorize or decline investment declarations submitted by your employees for the purpose of tax savings.

Access a consolidated view of all validated investment declarations, along with the necessary supporting evidence, submitted by individuals or all employees in a single location.

Tax compliance software refers to specialized software applications or platforms designed to assist businesses and individuals in meeting their tax obligations and ensuring compliance with tax laws and regulations. It provides tools and functionalities to streamline the process of tax preparation, reporting, and filing, helping users navigate complex tax codes and stay up to date with changing tax regulations.

Tax compliance software typically offers features such as automated data entry, accurate calculations, and real-time updates on tax law changes. It helps users organize and maintain financial records, generate necessary tax forms and reports, and identify potential deductions or credits that can optimize their tax liability.

By leveraging tax compliance software, businesses and individuals can minimize errors, reduce the risk of penalties or audits, and save significant time and effort in the tax preparation process. It offers a centralized platform to manage tax-related information, ensuring accuracy and consistency while simplifying the overall tax compliance process.

Overall, tax compliance software empowers users to maintain compliance with tax laws, enhance efficiency, and make informed financial decisions. It is a valuable tool for businesses of all sizes and individuals seeking to navigate the complexities of tax requirements effectively

Tax management features are functionalities or capabilities offered by tax management software or platforms that help businesses and individuals efficiently handle their tax-related activities. These features are designed to streamline tax processes, enhance accuracy, and ensure compliance with tax laws and regulations. Here are some common tax management features:

Tax Calculation and Reporting: Tax management software provides automated tax calculation capabilities, allowing users to accurately determine their tax liabilities or refunds based on their financial data. It generates comprehensive tax reports, including income statements, balance sheets, and tax summaries.

Tax Filing and Compliance: Tax management software simplifies the process of filing tax returns by providing electronic filing options. It ensures compliance with tax regulations and deadlines, reducing the risk of penalties or audits. It may also offer integration with tax authorities' systems for seamless submission.

Deductions and Credits: The software helps identify eligible deductions and tax credits by analyzing financial data. It maximizes potential savings by guiding users through available tax breaks specific to their circumstances, such as business expenses, education expenses, or energy-saving initiatives.

Record Keeping and Document Management: Tax management software allows users to organize and store essential tax documents electronically. It helps maintain an organized record of income, expenses, receipts, and other necessary documents, eliminating the need for physical paperwork and facilitating easy access during audits or inquiries.

Real-Time Updates and Compliance Alerts: Tax laws and regulations frequently change, and tax management software keeps users informed about updates and compliance requirements. It sends alerts and notifications regarding important deadlines, policy changes, or new tax laws that may impact their tax obligations.

Integration with Accounting Systems: Integration with accounting software or financial management systems ensures seamless data transfer between platforms. It streamlines the flow of financial information, eliminating manual data entry errors and saving time in reconciling financial records with tax calculations.

Multi-Jurisdiction Support: For businesses operating in multiple jurisdictions, tax management software often supports various tax systems, including different tax rates, rules, and forms. It simplifies the management of taxes across different regions, ensuring accurate reporting and compliance in each jurisdiction.

These tax management features collectively assist businesses and individuals in effectively managing their tax-related tasks, minimizing errors, maximizing tax savings, and maintaining compliance with applicable tax laws and regulations.

Tax management software offers a wide range of advantages, including streamlined payslip generation, for businesses and individuals. With its advanced capabilities, the software simplifies the process of generating accurate payslips. By automating the calculations and incorporating relevant tax information, it ensures precise deductions and withholding amounts, resulting in error-free payslips. This feature saves time and effort, allowing payroll administrators to swiftly generate payslips for employees. Moreover, the software maintains compliance with tax regulations, ensuring that the correct tax withholdings are applied to each employee's payslip. With its integrated payslip generation functionality, tax management software becomes a powerful tool for efficient payroll management and accurate financial record-keeping.