Ever wondered why a part of your salary is set aside every month before it reaches your bank account? That amount is called PF contribution. PF stands for Provident Fund, a government-backed savings scheme designed to help employees build long-term financial security. A fixed portion of an employee’s basic salary is deducted as employee PF contribution, and the employer adds their share as well. This mandatory deduction ensures disciplined savings for retirement and financial emergencies. In India, PF is governed and managed by the Employees’ Provident Fund Organisation (EPFO) under the Ministry of Labour and Employment.

Who Is Eligible for PF Contribution in India?

PF eligibility in India is governed by the Employees’ Provident Funds (EPF) Act, 1952. As per the Act, any establishment employing 20 or more employees must register under EPF and deduct PF for eligible staff. This rule applies across industries, including private companies, factories, startups, MSMEs, and large enterprises.

One of the most common questions around PF contribution is the ₹15,000 salary threshold. Employees earning a basic salary of ₹ 15000 or less per month are mandatorily covered under EPF, and PF contribution must be deducted from their salary. For employees earning above ₹15,000, it is not compulsory, but it can continue if both the employee and employer agree.

This brings in the concept of mandatory vs voluntary PF. Mandatory PF applies to eligible employees under the wage limit, while Voluntary Provident Fund (VPF) allows employees with higher salaries to contribute more than the standard amount for better long-term savings.

rules apply uniformly to startups, MSMEs, and large companies once they meet the employee count requirement. Company size does not exempt an employer from EPF compliance, making PF contribution a critical payroll and compliance responsibility for all growing businesses in India.

PF Contribution Percentage: Employee v/s Employer Explained

A common question among salaried employees is what percentage of salary is PF contribution? In India, rates are standardized under the Employees’ Provident Funds (EPF) Act, 1952, and followed uniformly by eligible employers across sectors.

Employee PF Contribution Percentage

An employee contributes 12% of basic salary plus dearness allowance (DA) towards PF every month. This amount is deducted directly from the salary and shown clearly in the payslip. The employee’s entire contribution is deposited into the EPF account, where it earns interest as notified annually by the EPFO.

Employer PF Contribution Percentage

The employer also contributes 12% of basic salary plus DA for each eligible employee. This contribution is statutory and mandatory once EPF applicability is triggered. The employer’s share is divided between provident fund savings and pension benefits.

EPF vs EPS Breakup Explained

Out of the employer’s total 12% contribution:

- 8.33% is directed towards the Employees’ Pension Scheme (EPS), calculated on a maximum salary ceiling of ₹15,000

- 3.67% is credited to the Employees’ Provident Fund (EPF)

The employee’s full 12% contribution goes entirely into the EPF account along with the employer’s EPF share.

PF Contribution Percentage Table

| Contribution Type | Percentage | Account |

| Employee PF Contribution | 12% | EPF |

| Employer EPF Contribution | 3.67% | EPF |

| Employer EPS Contribution | 8.33% | EPS |

| Total PF Contribution | 24% | EPF + EPS |

Standard Compliance Note

it is calculated only on basic salary plus DA, not on gross salary. These rates are applicable unless the employer has obtained specific exemptions under EPFO rules.

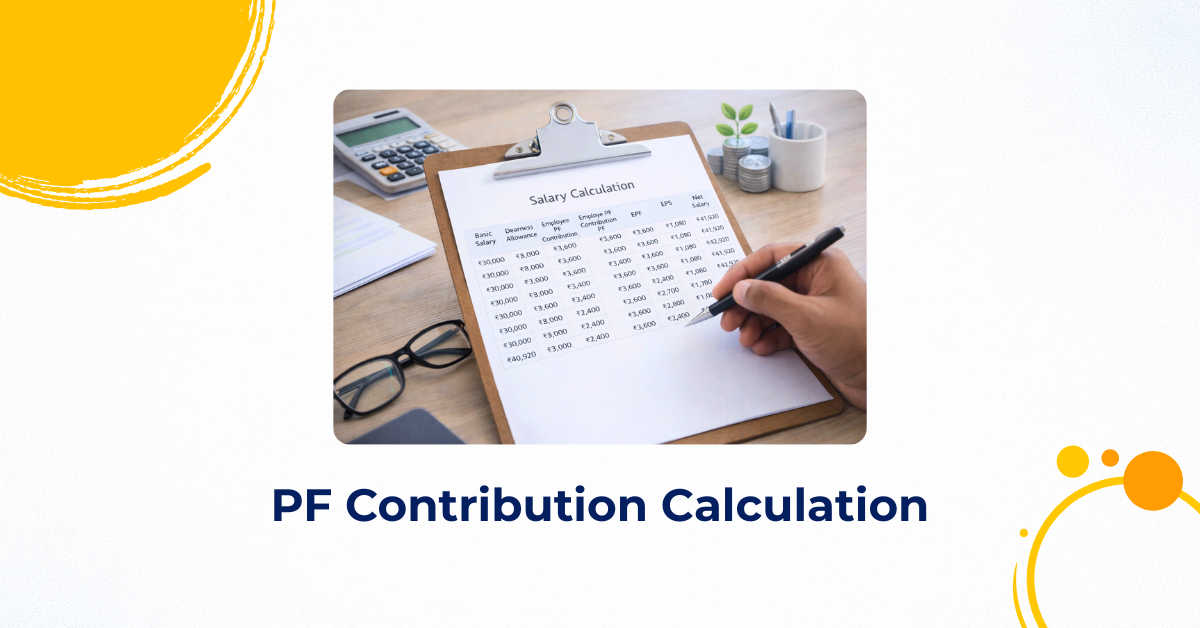

PF Contribution Calculation Explained (With Example)

Understanding PF calculation helps employees verify salary deductions and enables employers to run accurate, compliant payroll. PF is not calculated on gross salary. It is calculated only on Basic Salary plus Dearness Allowance (DA), as defined under EPF rules.

How PF Is Calculated on Basic + DA

PF contribution is calculated as a percentage of Basic Salary + DA

- Employee PF contribution: 12% of Basic + DA

- Employer PF contribution: 12% of Basic + DA

Out of the employer’s 12%, a portion goes to EPF and EPS, as per standard PF rules.

Step-by-Step PF Calculation Example

Let’s understand PF calculation step by step using simple numbers:

- Identify Basic Salary + DA

- Calculate 12% employee PF contribution

- Calculate 12% employer PF contribution

- Split employer contribution into EPF and EPS

PF Calculation for ₹15,000 Salary

If an employee’s Basic Salary + DA is ₹15,000:

- Employee PF = 12% of ₹15,000 = ₹1,800

- Employer PF = 12% of ₹15,000 = ₹1,800

- EPF share = 3.67% of ₹15,000 = ₹550.50

- EPS share = 8.33% of ₹15,000 = ₹1,249.50

Total monthly PF contribution = ₹3,600

PF Calculation Above ₹15,000 Salary

When Basic + DA exceeds ₹15,000, PF calculation depends on company policy:

- Many employers cap at ₹15,000

- Some allow on actual Basic salary with mutual consent

For example, if Basic + DA is ₹25,000 (with PF capped):

- Employee PF = 12% of ₹15,000 = ₹1,800

- Employer PF = 12% of ₹15,000 = ₹1,800

If PF is calculated on full salary:

- Employee PF = 12% of ₹25,000 = ₹3,000

- Employer PF = 12% of ₹25,000 = ₹3,000

Tax Benefits on PF Contribution: At a Glance

PF is not just a retirement savings tool; it also offers significant tax advantages at every stage of employment. From monthly salary deductions to final withdrawal, PF helps salaried individuals reduce tax liability while building long-term financial security. Understanding how PF is taxed allows employees to make smarter decisions about savings and tax regimes.

Tax Benefits for Employees

One of the biggest advantages for employees is the Section 80C tax deduction. The amount contributed by an employee towards PF is eligible for deduction of up to ₹1.5 lakh per financial year under Section 80C of the Income Tax Act. Since PF is deducted directly from salary, it becomes one of the most convenient and disciplined tax-saving options available to salaried individuals. This makes PF especially suitable for employees seeking a low-risk, long-term savings avenue with assured tax benefits.

Tax Treatment of Employer

Employer also enjoys favorable tax treatment. The employer’s contribution is tax-exempt up to 12% of the employee’s basic salary plus dearness allowance. Any contribution beyond this limit is treated as taxable income for the employee. When kept within prescribed limits, employer PF significantly boosts retirement savings without increasing the employee’s taxable salary, making it a highly efficient component of the compensation structure.

Tax on PF Withdrawal: When Is It Tax-Free?

PF withdrawals are completely tax-free if an employee completes five continuous years of service. This includes service across multiple employers, provided PF accounts are properly transferred during job changes. However, if PF is withdrawn before completing five years of continuous service, the amount may become taxable and TDS may apply, depending on the withdrawal value and PAN submission.

PF Contribution Under New vs Old Tax Regime

Under the old tax regime, employee PF contribution qualifies for Section 80C deduction, offering direct tax savings. In contrast, the new tax regime does not allow Section 80C deductions. However, employer PF within the specified limit remains tax-exempt under both regimes, ensuring PF continues to be a valuable savings tool regardless of the chosen tax structure.

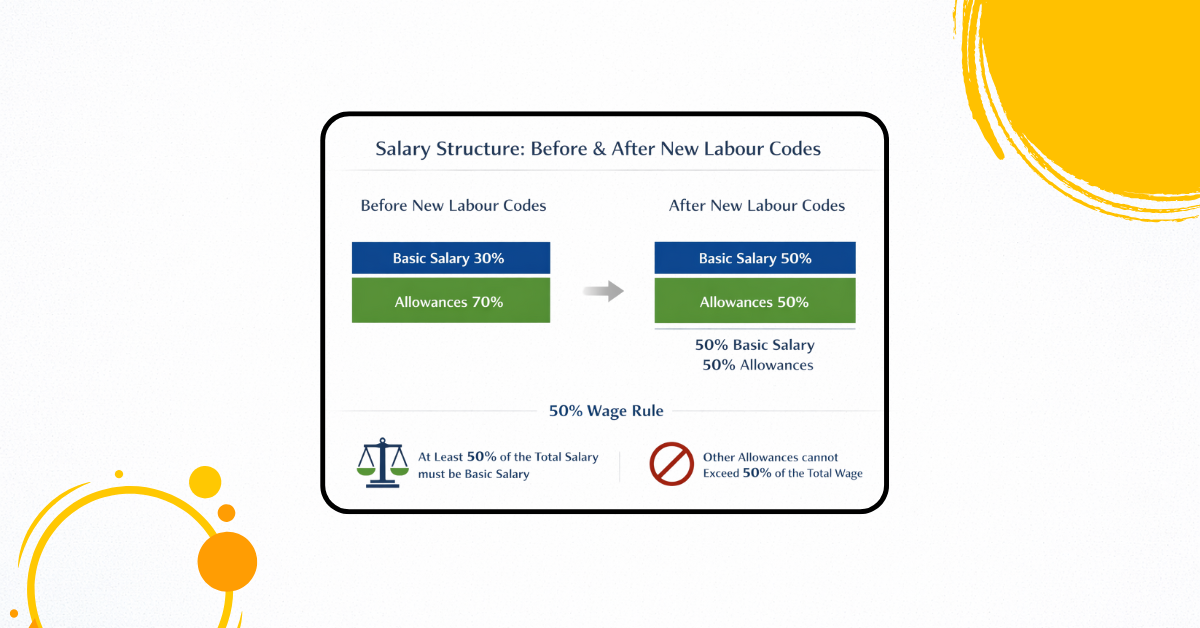

PF Contribution Under New Labour Codes: What Has Changed?

With the introduction of India’s new labour codes, PF contribution rules are moving towards greater transparency and uniformity. The Code on Social Security, 2020, which will eventually replace multiple existing labour laws, aims to simplify employee benefits such as Provident Fund, gratuity, and insurance under a single framework.

How PF Contribution Is Impacted by New Labour Codes

Under the new labour codes, it continues to be calculated on Basic Salary plus Dearness Allowance (DA). However, the definition of wages has been standardized. As per the code, allowances cannot exceed 50% of total remuneration. If allowances go beyond this limit, the excess amount will be added back to wages for PF calculation.

This change is expected to increase PF contribution amounts for employees whose salary structure currently includes a high percentage of allowances. While this may reduce take-home salary in the short term, it significantly improves long-term savings and retirement benefits.

What Does This Mean for Employees?

Employees may see:

- Higher PF contributions

- Better retirement corpus

- Increased gratuity benefits

- Lower immediate take-home pay

Over time, the new structure ensures fair and consistent social security coverage across industries.

What Does This Mean for Employers?

Employers will need to:

- Redesign salary structures to align with the 50% wage rule

- Recalculate PF contribution accurately

- Ensure payroll systems are updated for compliance

- Maintain clear communication with employees

Current Status of Implementation

Although the new labour codes are not yet fully implemented nationwide, many organizations are proactively aligning their payroll policies to avoid future compliance challenges.

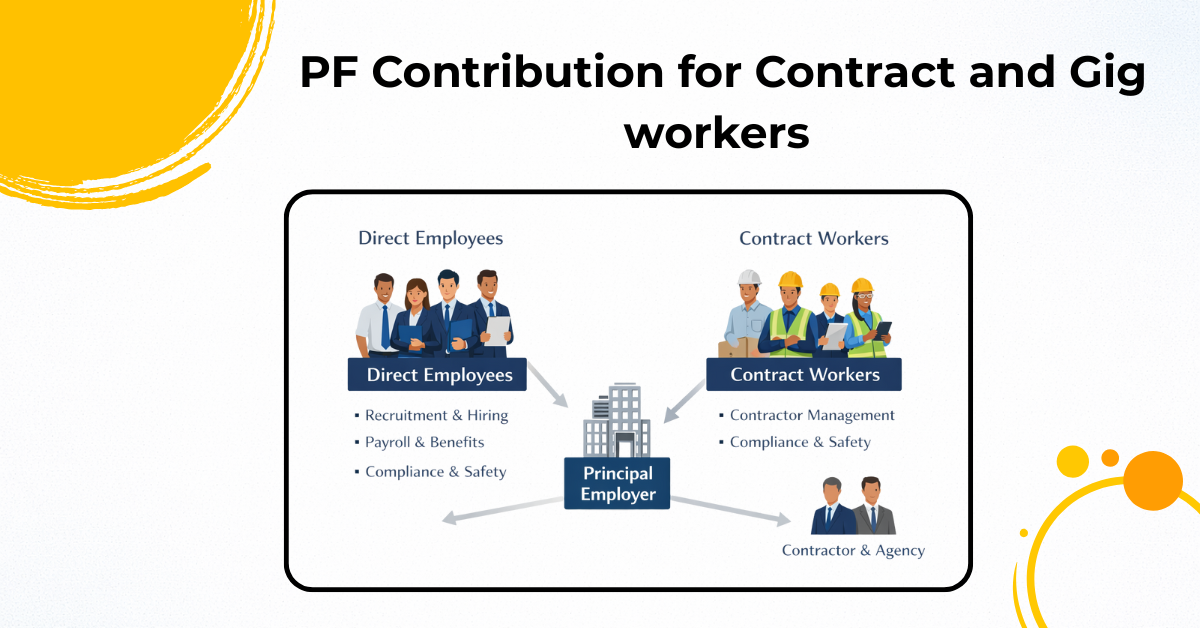

PF Contribution Rules for Contract, Temporary & Gig Workers

PF contribution for contract, temporary, and gig workers is one of the most misunderstood areas of Indian labour compliance. However, under Indian law, employment type does not decide PF applicability — the nature of work and employer relationship does. Understanding these PF contribution rules is critical for both businesses and workers to avoid non-compliance and loss of social security benefits.

PF Applicability for Contractual Staff

Contractual and temporary employees are eligible for PF contribution if they are employed in an EPF-covered establishment and earn wages within the prescribed limit. Whether an employee is hired for a fixed term or short duration, PF contribution becomes mandatory once eligibility conditions are met. Contract duration or job title does not exempt employers from PF compliance.

Role of the Principal Employer

In contract labour arrangements, the principal employer holds ultimate responsibility for ensuring PF contribution is deposited. Even if a contractor or staffing agency handles payroll, the principal employer must ensure that PF deductions are correctly made and deposited with EPFO. In case of default, authorities can recover dues directly from the principal employer.

PF Rules for Third-Party Payroll Employees

Employees working on third-party payroll, such as staffing or outsourcing agencies, are also covered under PF contribution rules. The payroll vendor is responsible for deduction and deposit, but compliance accountability still rests with the principal employer. Regular audits and documentation are essential to ensure statutory compliance.

Legal Responsibility and Compliance

Non-payment or delayed PF contribution for contract or temporary workers can result in penalties, interest, and legal action. Ensuring PF compliance for all categories of workers protects employee rights and safeguards businesses from regulatory risks

Summing Up

PF contribution plays a vital role in salary planning, compliance, and long-term financial security in India. It helps employees understand where their money goes, how it grows, and when it can be withdrawn, while enabling employers to meet statutory obligations accurately. By knowing who is eligible, how PF is calculated, what rules apply, and how new labour laws may impact contributions, readers can clearly track PF deductions in their payslips and plan better for the future. This clarity ensures transparency, compliance, and confidence for both employees and organizations.