Experience Convenience with our Online Payslip Generator

Generate Employee Payslips Instantly with Just One Click

Existing User? Sign In

Generate Employee Payslips Instantly with Just One Click

Existing User? Sign In

Automate payroll with a reliable salary slip generator. Enter the components, and let the tool do the heavy lifting. No spreadsheets, no manual errors—just fast and accurate results.

Generate multiple payslips in one go. Whether you’re managing payroll for 5 or 5,000 employees, the online payslip generator scales effortlessly to meet your needs.

Store and access payslips securely in the cloud. Employees can view or download their slips anytime, from any device—ensuring seamless accessibility.

Built to support evolving business needs, the tool offers a smooth, intuitive experience for generating payslips quickly and accurately—no complexity, just results.

Simplify payroll processing with our online payslip generator, designed for accuracy, speed, and security. Generate and distribute payslips in bulk, ensuring error-free salary disbursement with just one click. Enjoy cloud-based payslip storage, mobile-friendly access, and a seamless experience for businesses of all sizes.

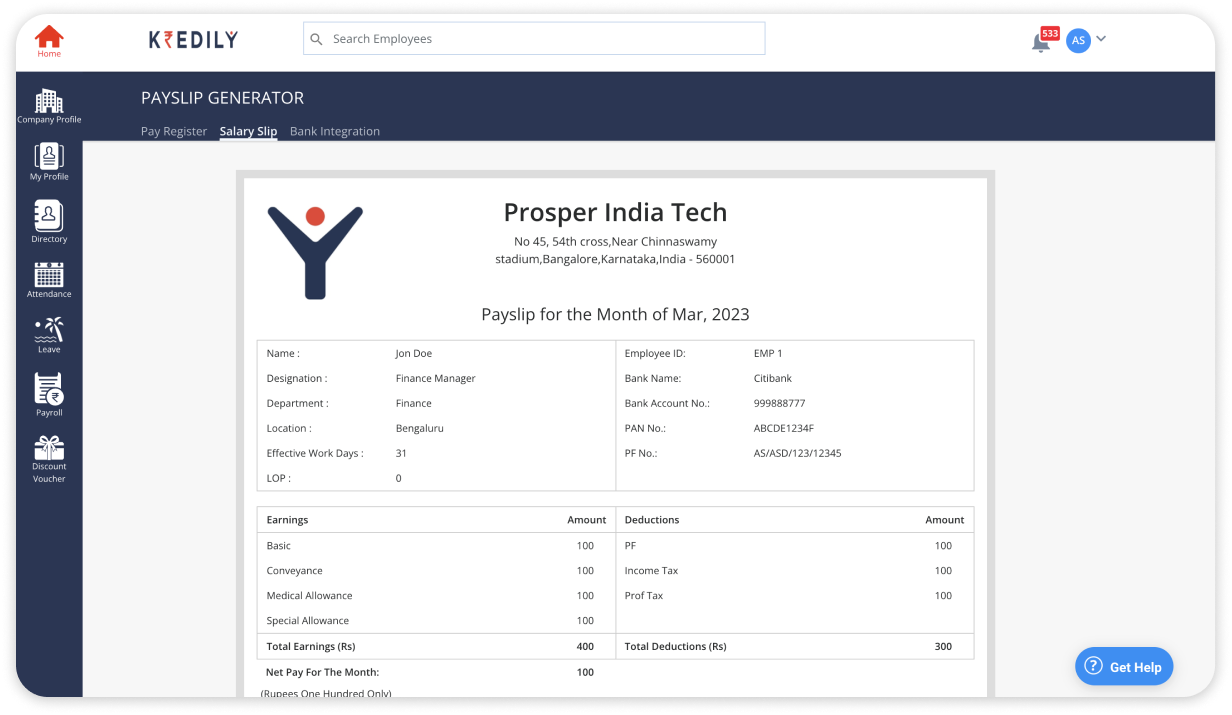

Generate professional and accurate payslips instantly. Automate salary calculations, eliminate manual errors and ensure seamless payroll processing for businesses of all sizes.

Sign up and complete your account setup by defining your attendance rules and employee data and you are good to go!

Kredily's automated payslip generation offers a seamless solution for effortlessly producing precise and comprehensive employee payslips.

Generate professional, company-branded payslips with your logo and business details. Ensure consistency and credibility while streamlining bulk payroll processing.

Access and store payslips anytime, anywhere! Our cloud-based system ensures your payroll data is safe, allowing employees to securely download their payslips whenever needed.

Create and access payslips on the go! Our mobile-friendly payslip generator lets employees download their salary slips straight from their smartphones—quick, easy, and hassle-free.

Yes, Kredily’s online payslip generator supports department-wise configurations, allowing you to define unique salary structures and generate accurate payslips based on team-specific templates.

Absolutely. The salary slip generator lets you add custom components like HRA, LTA, conveyance, and other allowances or deductions to suit your organization’s payroll policy.

You can easily include retro pay or arrears manually while generating the payslip. This ensures accurate payout history, even when backdated changes occur in the payroll cycle.

Yes, with Kredily’s online salary slip generator, you can bulk-upload employee salary details using a pre-defined format, reducing manual entry and accelerating payslip generation.

Payslips generated via Kredily’s platform comply with Indian labor laws and contain all statutory elements such as PAN, UAN, EPF, ESI, and TDS—ensuring you’re always audit-ready.

Yes, the platform allows you to preview each payslip before the final download. This ensures that all salary components, deductions, and branding are accurate and well-formatted.

You can personalize the payslips by uploading your company logo and adding your organization’s name, address, and contact details—creating a branded and professional look.

Yes, the payslip generator includes robust role-based access controls. HR managers, finance teams, and admin-level users like the CEO can access and manage payslip generation according to their roles. This ensures secure handling of payroll data while allowing necessary visibility and control across departments.

Each month’s generated payslips are automatically archived within the employee’s profile, making it easy to track salary history, re-download past slips, and maintain clear records.

Access control is role-based. Only admins or HR personnel with proper permissions can generate, view, or modify payslips. Employee access is limited to their own records only.