Effortless Tax Management for Payroll Processing

Automate Tax Management and Maximize Tax Efficiency

Existing User? Sign In

Automate Tax Management and Maximize Tax Efficiency

Existing User? Sign In

Browse through tax investment options, declare your investment and submit proof online.

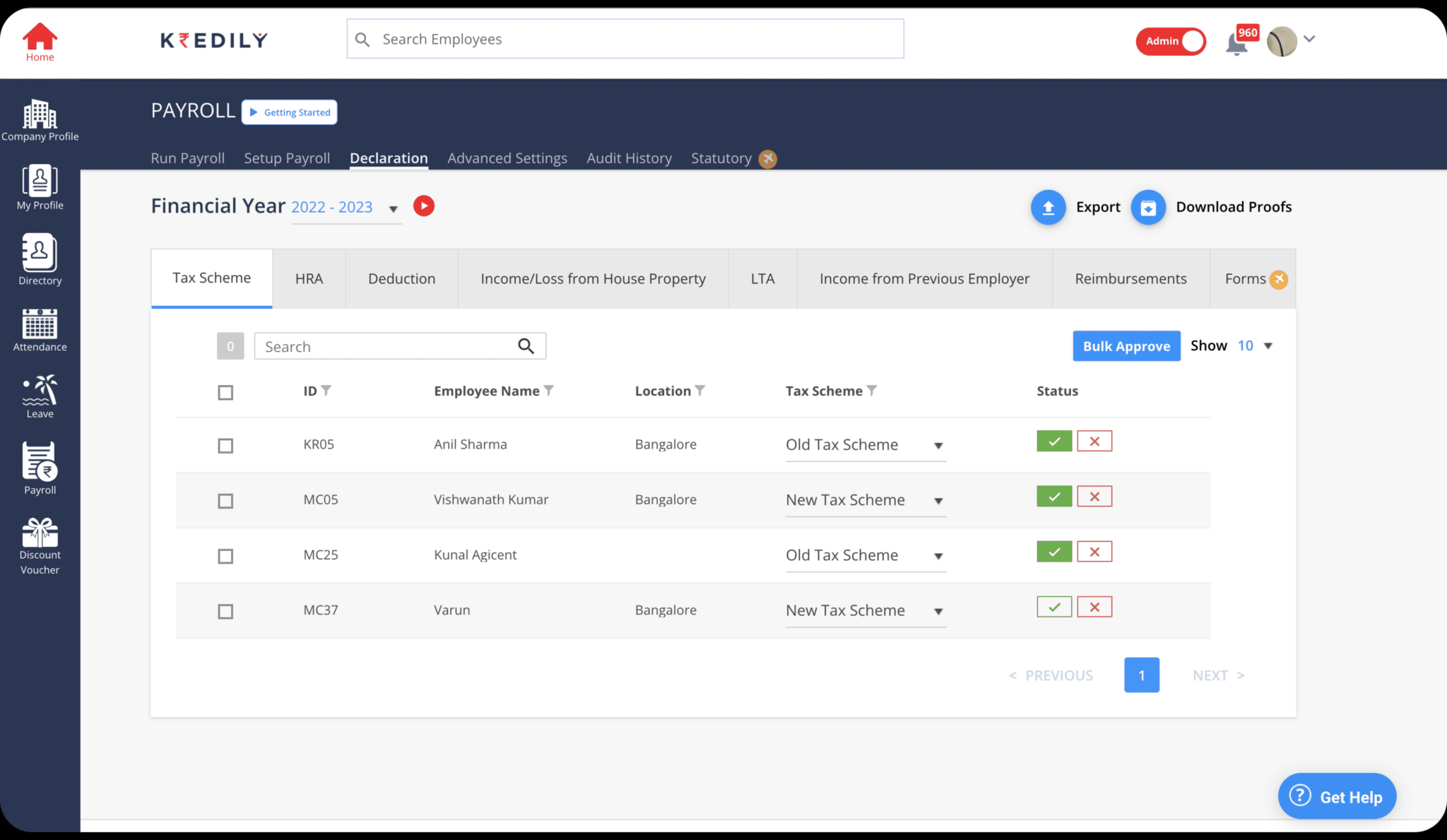

Authorize or decline investment declarations submitted by your employees for the purpose of tax savings.

Access a consolidated view of all validated investment declarations, along with the necessary supporting evidence, submitted by individuals or all employees in a single location.

Easily generate comprehensive tax reports and summaries for internal review or for submission to tax authorities. Our system provides detailed breakdowns of all transactions and declarations, ensuring full transparency..

Your sensitive financial data is protected with state-of-the-art encryption and robust security measures. Our platform is designed to ensure the confidentiality and integrity of all user information and tax declarations.

Get assistance from our dedicated support team to resolve any queries or issues related to your tax filings. We provide timely and expert guidance to help you navigate the entire tax management process with ease.

Tax management in payroll refers to the structured process of calculating, deducting, and reporting taxes such as TDS (Tax Deducted at Source) from employee salaries. For employees, it ensures accurate monthly deductions and prevents sudden year-end tax burdens. For employers, it helps maintain compliance with the Income Tax Act.

Kredily’s payroll software simplifies this by automatically applying the latest tax slabs, exemptions, and deductions, ensuring both accuracy and transparency in salary disbursements. This not only builds employee trust but also saves HR teams countless hours of manual computation.

Income projection: Kredily bases TDS on projected annual salary so deductions are spread evenly across months.

Live declarations: Employees declare investments digitally; updates flow into the next payroll run.

Automated computation: The system computes TDS after exemptions/deductions to keep monthly taxes accurate.

On-time payslips: Precise payslips are generated quickly so employees see the tax breakup clearly.

Section 80C: EPF/PPF, ELSS, life insurance, tuition fees (aggregate up to ₹1.5 lakh).

Section 80D: Health insurance premium for self/family.

HRA: For those living in rented accommodation (subject to rules).

Section 24(b): Home-loan interest.

NPS (80CCD(1B)): Additional ₹50,000 over 80C.

80G: Donations to eligible institutions.

HRA → Rent receipts and (where asked) rental agreement.

80C → Investment statements/receipts (PPF, ELSS, LIC, etc.).

80D → Health-insurance premium receipt/policy.

Home loan → Annual interest/principal certificate from lender.

80G → Donation receipts with PAN of donee (as applicable).

Upload happens in Kredily’s self-service interface; HR validates digitally to avoid paperwork.

Employees are generally required to submit their tax declarations at the start of the financial year (April) and proofs around January–February before final payroll processing.

Key details:

Declaration Window: Employers usually open this in April to allow employees to share projected investments.

Proof Submission: Around January or February, employees must provide supporting documents (like LIC receipts, rent agreements, PF contribution statements).

Payroll Impact: If proofs are not submitted, higher TDS is deducted in the final quarter.

With Kredily: The platform sends automated reminders, provides a digital upload facility for proofs, and calculates revised tax deductions instantly—making the process smooth and error-free.

Form 16 is a certificate issued by employers that details the tax deducted from an employee’s salary and deposited with the government. It serves as proof of income and tax paid.

Why it matters:

Income Proof: Essential while filing ITR (Income Tax Return).

Verification: Confirms that the employer has correctly deposited TDS.

Loan/Financial Needs: Often required for loan approvals or visa applications.

With Kredily, Form 16 is automatically generated and available for employees to download. This eliminates dependency on manual preparation and ensures all statutory formats are correctly followed.

If an employee misses the tax declaration or proof submission deadline, the employer is required to deduct higher TDS from the salary based on default taxable income. This means your take-home pay may temporarily reduce because exemptions and deductions were not considered.

However, Kredily helps reduce the impact of such delays:

Automated Reminders: Employees receive timely email and in-app alerts before deadlines so they don’t miss out.

Digital Submission Flexibility: Even if the proof is submitted late but before final payroll processing, HR can still update and adjust TDS within the system.

Transparency for Employees: Employees can immediately see updated tax calculations and revised deductions in their Kredily self-service portal.

Year-end Adjustment: If declarations remain unsubmitted, excess TDS deducted can still be claimed later while filing the Income Tax Return (ITR).

So while missing deadlines may affect immediate take-home salary, Kredily ensures the process remains transparent and gives employees maximum chances to update proofs on time.

Yes, advanced payroll tax management systems are designed to factor in multiple components beyond basic salary. Kredily, for instance, automatically applies tax rules on:

Reimbursements (like medical or travel): Non-taxable up to certain limits, beyond which tax is applied.

Bonuses/Incentives: Taxed as part of salary under “income from salary.”

Allowances (HRA, LTA, special allowance): Correct exemptions applied (e.g., HRA exemption based on rent paid, city, salary).

One-time Payments: Correctly included in monthly TDS computations.

This automation ensures accurate taxation and prevents employee grievances around over- or under-deductions.

Here’s a polished rewrite in the same detailed + practical style you asked for:

Employers usually set a deadline between January and March for employees to submit tax-saving proofs so that the final TDS (Tax Deducted at Source) can be adjusted before the financial year ends. Missing this deadline often leads to higher TDS deductions, which employees may need to claim back later while filing their income tax return.

With Kredily, this process becomes much smoother and more organized:

Customizable Deadlines: HR can set proof submission timelines within the system based on company policy and compliance requirements.

Automated Reminders: Kredily sends timely reminders through email and in-app notifications so employees don’t forget important dates.

Employee Self-Service: Employees can upload proofs digitally on the platform, reducing paperwork and delays.

Real-time Status Tracking: Both employees and HR teams can monitor whether proofs have been submitted, verified, or are still pending.

This proactive approach ensures employees get maximum tax benefits while HR teams save time and avoid last-minute compliance hassles.

Manual payroll tax calculation is error-prone because of changing slabs, exemptions, and allowances. Automated payroll tools like Kredily eliminate these risks through:

Real-time Updates: System updates tax rules as per CBDT (Central Board of Direct Taxes).

Error-free Calculations: Removes chances of human mistakes in complex formulas.

Bulk Processing: Handles tax computations for 10 to 10,000 employees in seconds.

Transparency: Employees can view deductions clearly in their payslips.

Kredily offers HR teams strong, built-in controls to manage and verify employee declarations with accuracy and compliance. Instead of manually cross-checking multiple proofs, HR can rely on an integrated system that ensures everything is transparent and error-free.

Key features include:

Document Verification Tools: HR can validate uploaded proofs (like rent receipts, investment certificates, insurance premiums, etc.) directly within the portal.

Automated Flagging: The system highlights incomplete, incorrect, or duplicate submissions, reducing the chance of errors slipping through.

Approval Workflows: HR managers can review, approve, or reject declarations with just a few clicks, while maintaining a digital record of all actions.

Audit Trail: Every change or approval is logged, making it easy for HR to stay compliant and prepared for audits.

Policy Customization: Organizations can define rules for what documents are acceptable and ensure uniform compliance across departments.

By combining automation with HR control, Kredily ensures that both employers and employees are aligned, minimizing risks of non-compliance and ensuring accurate payroll processing.

Here’s a refined and comprehensive rewrite for that FAQ, balancing both employee benefits and system advantages:

Payroll tax management can often feel complex and stressful for employees—especially when it comes to declarations, proofs, and last-minute deductions. Kredily makes this experience far more seamless, transparent, and stress-free through its employee-centric design.

Here’s how Kredily enhances employee experience:

Self-Service Portal: Employees can upload investment proofs, rent receipts, and other tax-related documents directly without depending on HR emails or physical submissions.

Real-Time Tax Visibility: Employees instantly see how their declarations impact taxable income and monthly take-home pay, helping them plan better.

Automated Reminders: Kredily notifies employees about upcoming declaration or proof deadlines, ensuring they don’t miss out on tax benefits.

Secure Digital Storage: All tax documents are stored safely in the cloud, reducing the risk of losing important paperwork.

Transparency in Payroll: Employees can track every TDS adjustment and view payslips with updated tax deductions, giving them full clarity.

Flexibility & Accuracy: Even if changes occur (like new investments or revised rent agreements), employees can update proofs digitally, and the system recalculates TDS instantly.

In modern workplaces, tax management cannot operate in isolation. Kredily integrates payroll tax with:

HRMS: Syncs employee data like salary, role, and benefits.

Attendance & Leave Systems: Overtime, leave encashments directly affect taxable income.

Accounting Software: Ensures tax entries match with books of accounts.

Compliance Tools: Automatically generates TDS challans, returns, and statutory reports.

This creates a single source of truth, reducing duplication and ensuring smooth financial audits.

During audits, companies must show clear tax deduction and deposit records. Kredily makes this easier through:

Digital Records: Maintains employee-wise tax deduction history.

Instant Reports: Generates TDS, Form 16, and challan records in one click.

Error-free Data: Reduces discrepancies that could trigger penalties.

Audit-ready Files: Provides structured reports that auditors can directly review.

In short, tax management software transforms audits from a stressful, week-long process into a few hours of simple reporting.

Sometimes, HR may need to override auto-calculations—for example, if an employee submits late investment proofs or an exemption wasn’t initially considered.

With Kredily: HRs have an option to manually adjust entries without disturbing the overall system.

Audit Trail: Every change is recorded for compliance transparency.

Employee View: Adjusted amounts reflect in the next payroll cycle, ensuring no confusion.

This controlled flexibility is crucial because while automation is efficient, HR must retain authority to handle exceptions.