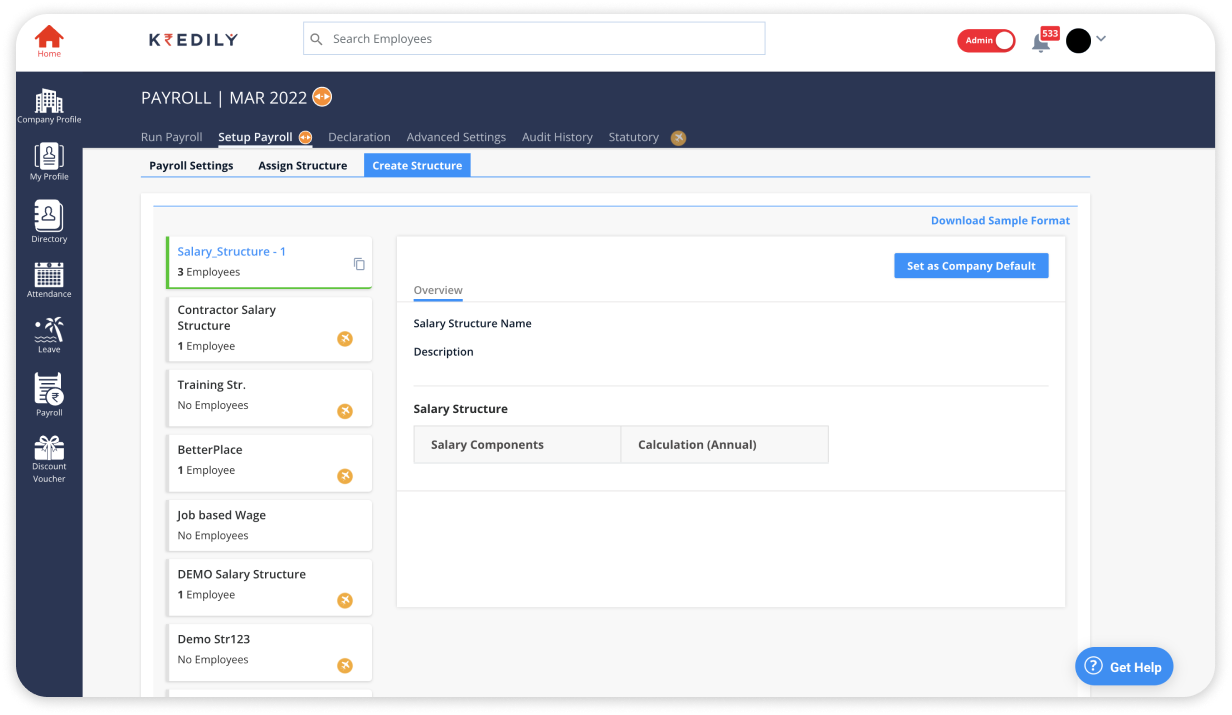

Custom Salary Structure for Indian Workplaces

Easily create salary structures tailored to your organization’s needs.

Existing User? Sign In

Easily create salary structures tailored to your organization’s needs.

Existing User? Sign In

Easily create salary structures tailored to your organization’s needs. Customize pay grades, salary breakups, and allowances for different roles. This flexibility ensures that your company’s salary structures are aligned with internal policies and external expectations, fostering equity across all departments.

The salary structure builder is designed to comply with Indian payroll regulations, ensuring your salary structures meet tax laws, statutory benefits, and compliance requirements. This minimizes the risk of non-compliance and penalties, keeping your organization secure.

Whether you’re in tech, healthcare, manufacturing, or any other industry, the salary structure tool adapts to your unique needs. Design pay structures that are specific to various roles—from entry-level to senior executives—catering to the demands of your sector.

The salary structure tool automatically calculates salaries based on the structure you’ve created. This eliminates manual errors and saves valuable time, allowing your team to focus on strategic HR initiatives while ensuring accurate and timely salary payouts.

Get started instantly using salary structure templates designed for Indian businesses. Spend less time configuring and more time growing.

Create pay structures tailored to your business. Add or remove salary components, set limits, and build custom salary arrangements that match your compensation strategy.

No complex tools or training are needed. The intuitive interface helps HR teams build, edit, and manage salary structures quickly and confidently.

Kredily HRMS provides unbeatable value with the lowest cost per user in the market.

A salary structure is a detailed breakdown of an employee’s total compensation. It typically includes components like Basic Pay, House Rent Allowance (HRA), Special Allowance, Performance Bonus, and Statutory deductions (PF, ESI, etc.). Having a clear structure helps with tax efficiency, compliance, and payroll transparency.

Use HR & payroll software like Kredily, which helps you:

Create and manage custom salary structures easily

Automatically calculate PF, ESI, professional tax, and income tax

Generate payslips and compliance reports in a few clicks

This not only saves time but also helps avoid manual errors and keeps you compliant.

Start with the annual CTC you want to offer. Break it down into:

Basic salary (usually 40–50% of CTC)

HRA (commonly 40–50% of Basic)

Special allowance or other allowances (like LTA, medical)

Employer contributions to PF, ESI, and gratuity

Use Excel or HR/payroll software (like Kredily) to calculate deductions and take-home pay automatically.

Common components include:

Basic Salary

HRA (House Rent Allowance)

Special Allowance

Bonus / Incentives

Provident Fund (Employer & Employee contributions)

Professional Tax / ESI (where applicable)

Gratuity

Some companies also add: Leave Travel Allowance (LTA), Medical Allowance, and other reimbursements.

CTC: Total annual cost to the company, including employer PF, gratuity, insurance, etc.

Gross salary: CTC minus employer contributions (PF, gratuity).

Take-home salary: Gross salary minus employee PF, professional tax, and income tax.

Increase components like HRA, LTA, and reimbursements (like internet, telephone) which have tax benefits. Avoid putting the entire amount under "Special Allowance", since that is fully taxable. Always consult a payroll expert or CA to match current tax rules.

CTC (Cost to Company) is the total annual cost a company spends on an employee, including salary, benefits, employer PF, insurance, and bonuses.

Take-home salary is what employees actually receive in their bank after deductions like PF, professional tax, and income tax.

In India, Basic Salary usually makes up 40–50% of CTC. Keeping it too low might save on PF contribution but could be non-compliant; too high increases PF and tax liability. Balance is key.

Technically, yes—but it’s not advisable. You’d lose out on tax benefits from allowances like HRA and LTA, and it might also raise PF and gratuity costs for the company.

It’s the balancing figure to complete the agreed CTC after allocating other components. It’s fully taxable, so it doesn’t help with tax savings.

Yes! Many HR software (including Kredily) offer built-in templates. Or, you can download Excel templates that let you adjust Basic, HRA, PF, etc., based on your company’s policy.

Ideally, changes happen at appraisal or annual review. Frequent changes can confuse employees and complicate compliance.

Small businesses may keep it simpler—Basic + HRA + Special Allowance. But even small companies must comply with PF, ESI, and tax rules if applicable.

Many use payroll software or consult a CA initially. Software can automate complex calculations and stay updated with compliance rules.

Yes! Many HR tools and payroll software offer built-in templates. For a small team, you can keep it simple:

Basic salary

HRA

Special allowance

PF & ESI (if applicable)

This covers tax, compliance, and keeps calculations straightforward.