Most of us are already unaware of the tax filing system and the pros and cons of the Old Tax Regime Vs New tax regime, which highlights the complexity of our tax system and the need for greater transparency and education around tax planning and compliance. As for now, the confusion is further compounded by the fact that taxpayers can switch between the two tax regimes yearly, making it difficult to plan long-term tax-saving strategies. The Finance Minister recently recommended substantial changes to the new tax system to encourage more individuals to adopt it. Although the new income tax regime was announced in Budget 2020, it became an option for taxpayers in 2021 despite being unpopular amongst taxpayers to date. These modifications are effective for the current financial year, i.e., from April 2023 to March 2024.

Furthermore, the new tax regime is optional, so individuals have to carefully weigh the benefits and drawbacks of each regime before making a decision.

As a taxpayer, there are several basic knowledge areas you should be aware of to fulfill your tax obligations and ensure that you comply with tax laws. Here are some essential areas of knowledge for taxpayers:

Source of Income

It’s important to understand your different income sources—whether salary, rental income, business earnings, or capital gains—and know how to classify and report each correctly.

Taxable income

You should be aware of what qualifies as taxable income and what is exempt or deductible. For example, certain earnings—like dividends or interest from tax-saving instruments—may be tax-free, while specific expenses can be deducted from your taxable income.

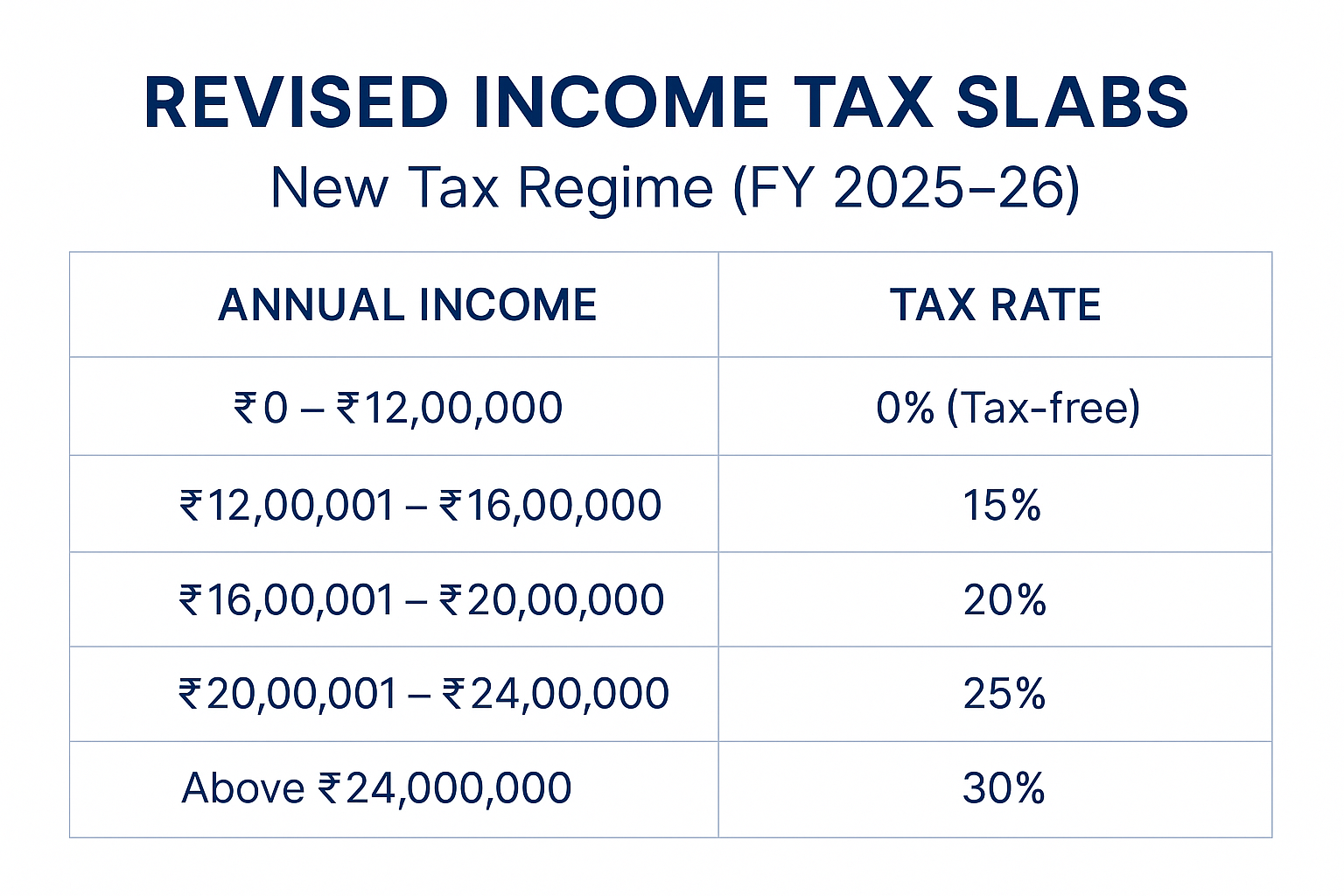

Tax slabs and rates

Knowing the tax slabs and rates applicable to your income level is crucial. Now the income tax slabs are different for old and new tax regimes, so it is important to know the latest tax slabs and rates.

Tax Filing requirements

Knowing when and how to file your tax returns is vital. Usually, the tax filing deadline in India is July 31, but it may be extended in some cases. You can file the tax returns either online or offline.

Tax Slab Rates

New tax slabs were implemented under the New Regime, with current rates reduced on income up to INR 15 Lakh. Check both tax slab rates in the table given below.

Thinking about which one to choose Old Tax Regime Vs New tax regime? Check the reasons below:

Reasons for opting for the new tax regime

- After changing the new tax slab for the current financial year, the new tax regime has become a clear option for individuals with income below Rs. 7,00,000 or Rs.7,50,000(with an additional standard deduction).

- Offers lower taxation rate for income up to Rs.15,00,000.

- No tension about keeping exemption claims records.

- Gives more liquidity to taxpayers by providing them with the flexibility of customizing their investments.

- Easy and simpler tax calculation

Reasons for opting old tax regime

- Promote taxpayers to save in schemes like PPF or ELSS for future events like medical emergencies, child education, marriage, and retirement.

- If you belong to a higher-income group, you cannot claim so many exemptions because of the limitation of spending or investing to maximize the benefits given under Section 80C/Section 80D.

- If you come into the senior or super senior citizens category, opting for the new regime will not give you a higher tax exemption than the old one.

- Can claim a high amount of exemptions or deductions under the old tax regime.

Exemptions applicable under Old Tax Regime Vs New tax regime

Whether you opt for the new or old tax regime, you will get certain advantages or exemptions in both tax regimes. These are:

- NPS or EPF contribution from the employer of up to 12% of the salary and up to 9.5% per annum interest on EPF.

- The interest received in the amount of upto Rs. 3500 on Post Office Savings Account under Section 10(15)(i)

- Gratuity amounts up to Rs. 20,00,000 received from the employer.

- The amount received from LIC under Section 10(10D) on maturity.

- Any income from Life Insurance.

- Income from agricultural farming.

- Retirement cum death benefit

- Standard reduction on rent.

- Compensation for Retrenchment.

- Leave encashment on retirement.

- Voluntary Retirement Scheme proceeds up to Rs.500000.

- Maturity amount and interest received on Sukanya Samriddhi Yojana or Public Provident Fund account.

- Scholarship received for education.

- Commutation of Pension. Under the new tax regime, you can claim deductions u/s 80CCD(2) and 80JJAA.

Overall, being aware of the above areas of knowledge can help you fulfill your tax obligations and ensure that you comply with tax laws. It is always a good idea to seek professional advice or consult the relevant tax authorities if you have any doubts or queries regarding your tax obligations.