Introduction

Gratuity is a significant financial benefit provided to employees as a token of appreciation for their long-term service. Understanding gratuity calculation in India is essential for both employers and employees to ensure compliance with the Payment of Gratuity Act, 1972 and to plan finances effectively. Unlike regular salary or provident fund contributions, gratuity is paid as a lump sum upon retirement, resignation, or in case of death or disability. Accurate gratuity calculation in india not only helps employees receive their rightful dues but also enables employers to manage financial liabilities efficiently, making it a crucial aspect of employee benefits in India.

What is Gratuity?

gratuity calculation in India is a statutory financial reward given by an employer to employees who have rendered continuous service, usually for five years or more. Unlike regular salary or benefits like provident fund (PF), bonuses, or pensions, gratuity is a one-time lump sum payment made at the time of retirement, resignation, death, or disability. Its primary purpose is to acknowledge an employee’s long-term commitment, loyalty, and contribution to the organization.

While PF is a retirement savings plan contributed monthly by both employee and employer, and bonuses are periodic incentives based on performance or company profits, gratuity stands apart as a legally mandated reward that is calculated based on the last drawn salary and total years of service. Pension, on the other hand, provides recurring monthly income after retirement, whereas gratuity is disbursed in a single payment.

In India, understanding gratuity calculation in India is crucial for employees to ensure they receive their rightful dues, and for employers to maintain compliance under the Payment of Gratuity Act, 1972. Although it is a one-time benefit, the amount can be substantial, making it an essential part of long-term financial planning. Correct gratuity calculation in India ensures transparency, prevents disputes, and reflects fair treatment of employees.

Legal Framework: Payment of Gratuity Act, 1972

Gratuity Calculation in India Formula:

The Payment of Gratuity Act, 1972 is the primary legislation governing gratuity payments in India. Enacted to reward employees for long-term service, the Act ensures that workers receive a fair financial benefit upon leaving an organization, whether due to retirement, resignation, death, or disability. It applies to establishments such as factories, mines, oilfields, plantations, ports, railways, shops, and offices with 10 or more employees, covering both private and government sectors.

Under this Act, employers are legally obligated to pay gratuity to eligible employees. The standard eligibility criterion requires an employee to have completed at least five years of continuous service, although this is waived in cases of death or disablement. The Act provides a structured approach for gratuity calculation in India, using the formula:

Gratuity = (Last Drawn Salary × 15 × Number of Years of Service) ÷ 26

This formula ensures transparency and uniformity across organizations.

The Act also defines strict compliance requirements and deadlines. Employers must disburse gratuity calculation in india does within 30 days of it becoming payable. Delays attract interest penalties, and employees can approach controlling authorities to resolve disputes. Additionally, employers are required to maintain proper records, handle nominations through Form F, and follow legal mandates in all gratuity payments.

Non-compliance with the Payment of Gratuity Act, 1972, can lead to legal consequences, fines, and prosecution, making it essential for employers to remain informed and compliant.

For official guidelines and detailed information, refer to the Ministry of Labour and Employment – Payment of Gratuity Act, 1972.

By understanding this legal framework, both employers and employees can ensure accurate gratuity calculation in India, timely disbursement of benefits, and strengthened trust within the workplace.

To be eligible for gratuity calculation in India, an employee must have completed a minimum of five years of continuous service with the same employer. However, this condition is waived in case of an employee’s death or disablement.

Eligibility Criteria for Gratuity in India

Understanding the eligibility criteria for gratuity calculation in India is crucial for both employees and employers to ensure accurate benefit computation and legal compliance. Under the Payment of Gratuity Act, 1972, gratuity is payable when an employee completes five years of continuous service in an organization. This rule ensures that long-term employees are rewarded for their sustained commitment and contribution to the company’s success.

However, there are certain exceptions to the five-year condition. In cases of death, permanent disability, or company closure, gratuity becomes payable even if the employee hasn’t completed the full five years. In such situations, the gratuity calculation in India is based on the actual period of service rendered, ensuring fair compensation for the employee or their nominee.

Standard Eligibility Rules

Eligibility for gratuity Calculation in india also depends on the type of employment:

-

Permanent Employees: Automatically covered under the Payment of Gratuity Act if they meet the minimum service requirement.

-

Contract Employees: Eligible if they are on the company’s payroll and their employment terms (salary, attendance, etc.) are directly managed by the organization.

-

Hybrid or Remote Employees: With the rise of flexible work models, gratuity eligibility applies as long as employees have continuous service under the same employer, as per the Act’s provisions.

From a compliance perspective, both employees and employers play a role in ensuring smooth gratuity calculation in india and payment. Employees should maintain accurate service records and nomination forms, while employers are responsible for timely disbursal, proper documentation, and communication regarding gratuity eligibility.

In essence, the gratuity calculation in India is not only about the final payout—it’s about recognizing long-term service, ensuring compliance, and maintaining trust between employers and employees. By understanding the eligibility rules and exceptions, organizations can create a transparent and employee-friendly compensation culture.

Gratuity Calculation Formula:

Accurate gratuity calculation in India is essential for both employees and employers to ensure compliance and fair payouts. The Payment of Gratuity Act, 1972 defines a standard formula for calculating gratuity for salaried employees:

Gratuity = (Last Drawn Basic + DA) × 15 × Number of Years of Service ÷ 26

Here’s a breakdown of each component:

| Component | Explanation |

|---|---|

| Last Drawn Basic + DA | Employee’s basic salary plus dearness allowance at the time of exit |

| 15 | Represents 15 days’ wages for every completed year of service |

| Number of Years of Service | Total completed years the employee has worked continuously |

| 26 | Number of working days in a month (excluding Sundays) |

| Gratuity Formula | Gratuity = (Last Drawn Basic + DA) × 15 × Years of Service ÷ 26 |

Examples of Gratuity Calculation in India

Example 1:

-

Last Drawn Salary: ₹30,000

Years of Service: 6

Gratuity = (30,000 × 15 × 6) ÷ 26 = ₹1,03,846 -

Example 2:

Last Drawn Salary: ₹50,000

Years of Service: 10

Gratuity = (50,000 × 15 × 10) ÷ 26 = ₹2,88,461

HRMS Automation & Online Calculation

Modern HRMS software can automate gratuity calculation in India, saving HR teams from manual errors and ensuring compliance. Employees can also use online gratuity calculators provided by the Ministry of Labour or payroll portals to estimate their expected payout. Automation helps organizations maintain transparency, generate reports instantly, and integrate gratuity computation with payroll and exit procedures.

By using the formula along with digital tools, employers and employees can simplify the gratuity calculation in inida process, making it accurate, efficient, and fully compliant with Indian labor laws.

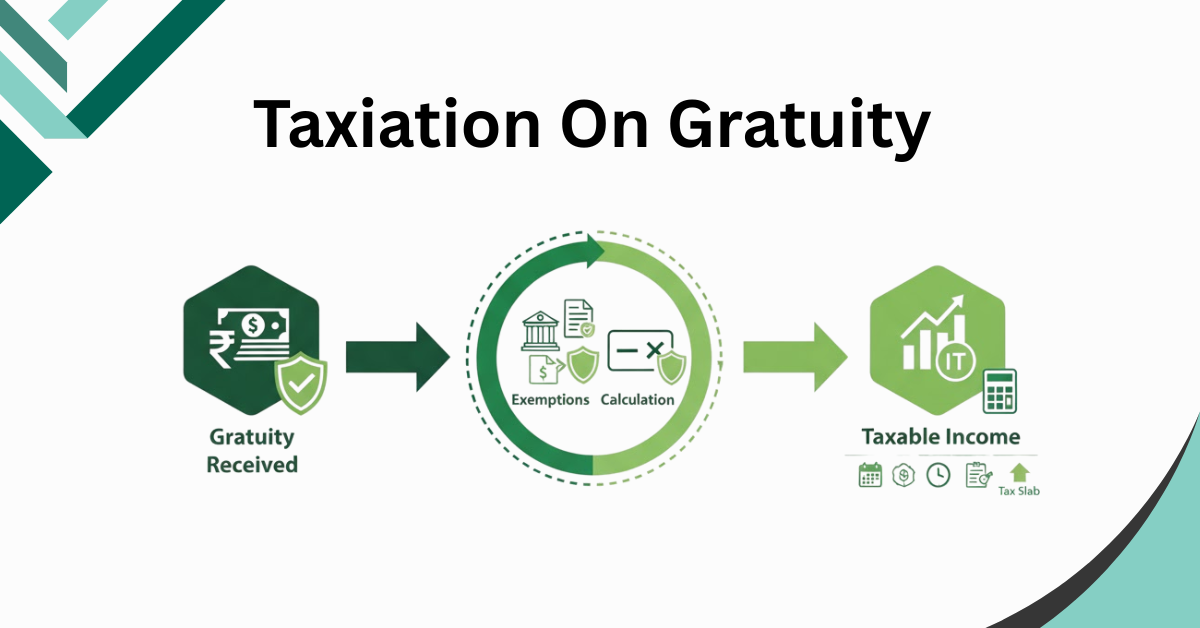

Income Tax on Gratuity:

Planning to leave your job or retire soon? Before you calculate your gratuity, it’s essential to know how it’s taxed in India — because the amount you actually receive can differ from what you expect.

For employees covered under the Payment of Gratuity Act, the tax-free limit is ₹20 lakh. This means that any gratuity amount received up to ₹20 lakh is fully exempt from income tax. Amounts exceeding this threshold are taxable as per the employee’s income tax slab.

The tax treatment also varies depending on the type of employment on Gratuity Calculation In India:

-

Government Employees: Gratuity received by government employees is fully tax-exempt, regardless of the amount.

-

Private Sector Employees (covered under the Act): Exemption is allowed up to ₹20 lakh. Any excess amount is taxable.

-

Private Sector Employees (exempted schemes): Certain organizations have gratuity schemes exempted under Section 10(10) of the Income Tax Act. In such cases, the amount received may also be tax-free up to the specified limits.

In practical terms, gratuity Calculation in india will appears in Form 16 issued by employers in the “Exempt Income” section, allowing employees to claim the exemption while filing their Income Tax Return (ITR). Employees should ensure that the exempted gratuity is correctly reflected in Form 16 to avoid discrepancies during tax filing.

For accurate planning, employees can calculate expected gratuity and assess its taxable portion if it exceeds the exemption limit. Employers, on the other hand, must ensure compliance with tax regulations while disbursing gratuity to prevent legal issues.

Gratuity Rules for Different Employee Types

The rules for gratuity calculation in India can vary depending on the type of employee, their employment sector, and the circumstances under which they leave the organization. Understanding these distinctions ensures compliance and fair treatment.

1. Private Sector vs Government Employees

-

Government Employees: Gratuity Calculation in india for government employees is fully tax-exempt, and the payout is usually calculated strictly based on service length and last drawn salary. Government rules tend to be uniform and transparent, providing long-term financial security.

-

Private Sector Employees: For private organizations, gratuity is calculated according to the Payment of Gratuity Act, 1972, with a maximum tax-free limit of ₹20 lakh. Employers may also choose to pay amounts higher than the statutory minimum as part of company policy.

2. International Employees Working in India

Employees from other countries who are employed in India may also be eligible for gratuity if they are covered under the Act and have continuous service with the Indian entity. Calculation follows the same formula:

Gratuity Calculation in india = (Last Drawn Basic + DA) × 15 × Years of Service ÷ 26

It’s important for international employees and employers to verify eligibility and tax implications under Indian law.

3. Employees Leaving Early vs Long-Serving Employees

-

Early Exit: Employees who resign before completing five years are generally not eligible, except in cases of death, permanent disability, or company closure, where gratuity is payable proportionally.

-

Long-Serving Employees: Employees with 5+ years of service receive gratuity as per the statutory formula, rewarding long-term commitment and loyalty. Employers must ensure timely disbursal to avoid penalties under the Act.

By recognizing these nuances, organizations can manage gratuity calculation in India effectively, ensuring that every employee—whether permanent, international, or hybrid—receives their rightful benefits while maintaining compliance with Indian labor laws.

Smart Gratuity Hacks You Should Know

Even though gratuity calculation in India follows a fixed formula, a few smart moves can help you maximize benefits and avoid delays.

1. Complete 4 Years and 240 days

Many firms consider 4 years + 240 days as 5 years of continuous service under gratuity law.

➡️Hack: Stay beyond 4 years and 8 months to qualify for gratuity.

2. Check Your CTC Breakdown

Your CTC may include gratuity, but it might not be funded.

➡️Hack: Verify if your employer has a gratuity trust or LIC policy for secure payment.

3. Use HRMS Tools

Modern HRMS platforms like Kredily automatically calculate gratuity in real time.

➡️Hack: Track your gratuity growth for better financial planning.

4. Stay Within the ₹20 Lakh Tax-Free Limit

Gratuity up to ₹20 lakh is tax-free; excess is taxable.

➡️Hack: Plan your payout timing with HR or a tax expert.

5. Nominate Wisely

Submit Form F to ensure your nominee receives the benefit without legal hassles.

Claiming Gratuity in India

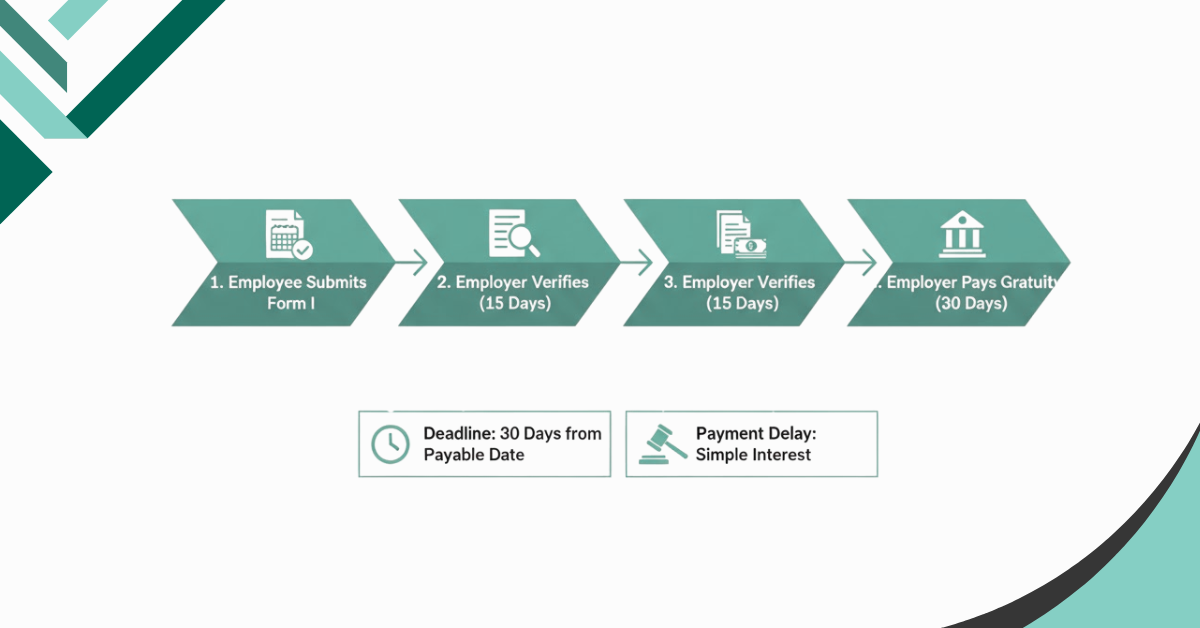

Claiming gratuity is a straightforward process, but understanding the requirements and timelines is essential for both employees and employers to ensure accurate gratuity calculation in India and timely disbursal.

Step-by-Step Process to Claim Gratuity

1. Documents Required

To claim gratuity, employees typically need to submit the following documents:

-

Form I: Application form for claiming gratuity, as specified under the Payment of Gratuity Act, 1972.

-

Service Certificate: A certificate issued by the employer confirming the duration of employment and last drawn salary.

-

Bank Account Details: For direct transfer of the gratuity amount.

-

Any additional documents requested by the employer, such as proof of age or resignation acceptance.

2. Step-by-Step Claim Process for gratuity calculation in india

-

Obtain and fill Form I from the employer or HR portal.

-

Attach the service certificate and provide bank account details.

-

Submit the completed application to the HR/payroll department.

-

The employer verifies the documents, calculates the gratuity using the statutory formula, and approves the payment.

-

Payment is credited to the employee’s bank account, and a payment receipt or acknowledgment is issued.

3. Timeline for Payment

The Payment of Gratuity Act mandates that the gratuity amount must be paid within 30 days from the date it becomes payable. If the employer fails to pay within this timeline, they are liable to pay interest on the delayed amount at the rate specified by the controlling authority.

4. Penalties for Delayed Payment

-

Interest on Delayed Payment:

-

If the gratuity is not paid within 30 days from the date it becomes payable, the employer must pay interest at 10% per annum on the delayed amount.

-

Interest is calculated from the date gratuity became payable until the actual date of payment.

-

-

Legal Penalties:

-

Employers who willfully fail to pay gratuity can face imprisonment up to 1 year or a fine of up to ₹10,000, or both, as per Section 7A of the Act.

-

In addition to fines and interest, employees can approach the Controlling Authority to enforce payment and resolve disputes.

-

Example:

-

If an employee is entitled to ₹2,00,000 gratuity and the employer delays payment by 6 months:

Interest = ₹2,00,000 × 10% × (6/12) = ₹10,000 extra payable.

Gratuity Forms Overview

Accurate documentation is a key part of gratuity calculation in India.

1. Form F – Nomination Form

Form F is used by employees to nominate one or more persons who will receive the gratuity in the event of the employee’s death. Key points:

-

Must include nominee’s name, relationship, age, and share of gratuity.

-

Can be updated anytime during employment by submitting a revised Form F.

-

Ensures the gratuity amount is paid directly to the intended nominee without legal disputes.

2. Form I – Gratuity Claim Application

Form I is submitted by employees to claim gratuity upon retirement, resignation, death, or permanent disability. Key points:

-

Requires employee details, service period, and last drawn salary.

-

Must be submitted along with supporting documents like service certificate and bank account details.

-

Enables the employer to verify eligibility and process timely payment within 30 days.

3. Other Relevant Forms

-

Some employers may use internal forms or HRMS-generated digital forms to streamline gratuity processing.

-

In cases of disputes, employees may need to submit additional forms to the Controlling Authority for resolution under the Act.

Using these forms ensures transparency, legal compliance, and smooth gratuity disbursal. Employees should maintain accurate records and keep nomination details updated, while employers must verify forms correctly to avoid penalties for delayed or incorrect payments.

Summing It Up:

Gratuity is not just a monetary benefit but also a symbol of appreciation for an employee’s dedicated service. Understanding its nuances, from eligibility criteria to taxation, is essential for both employers and employees.

Frequently Asked Questions:

- Is gratuity mandatory for all employees?

- Gratuity is typically mandatory for employees who have completed a specified period of continuous service, as defined by labor laws.

- Can an employer forfeit an employee’s gratuity?

- Gratuity forfeiture is possible in cases of employee misconduct, subject to the terms and conditions.

- How is gratuity taxed?

- The taxation of gratuity varies by country. In India, for example, there are exemptions up to a certain limit based on the employee’s years of service.

- When is the right time to claim gratuity?

- Employees can claim gratuity when they meet the eligibility criteria, usually at the time of retirement, resignation.

- Can an employee claim gratuity after five years of service?

- Yes, an employee can claim gratuity after completing a minimum of five years of continuous service.